Speak with an Admission Counselor

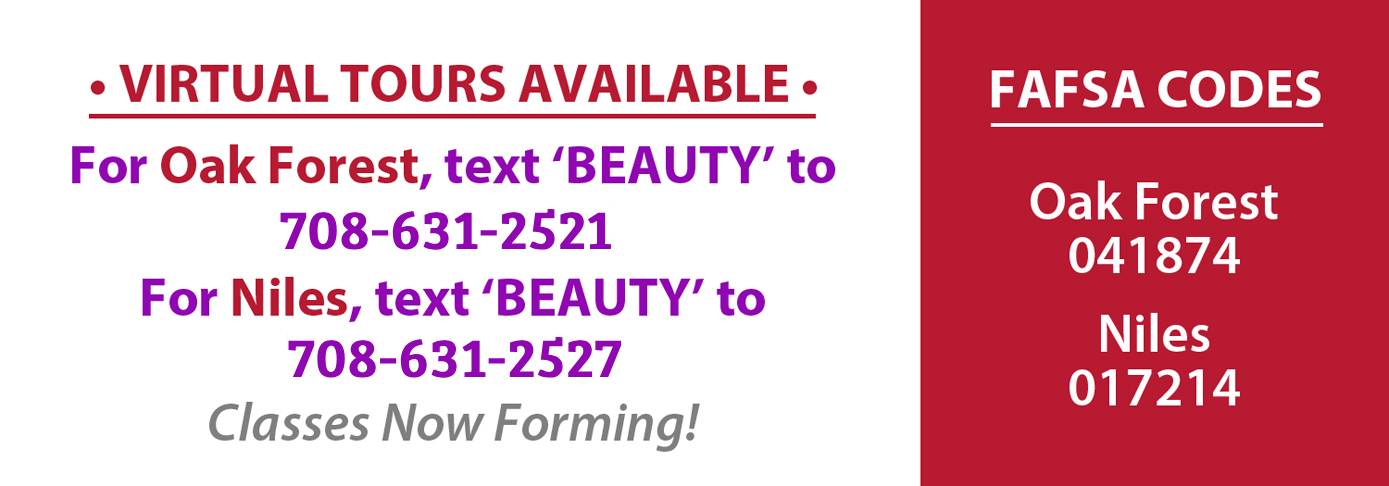

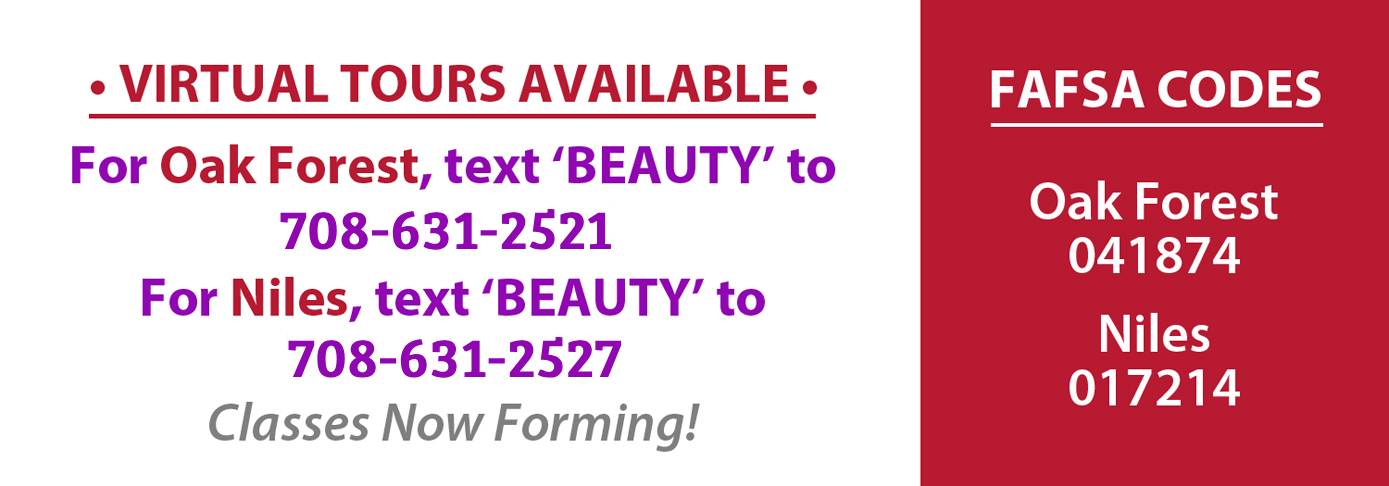

Text: 708-631-2527

Call: 708-541-8527

Speak with an Admission Counselor

Text: 708-631-2527

Call: 708-541-8527

For information on graduation rates, median debt of students completing the program, and other important information, please Click here

How much will this program cost me?*

What other costs are there for this program?

For further program cost information click here.

*The amounts shown above include costs for the entire program, assuming normal time to completion. Note that this information is subject to change.

What financing options are available to help me pay for this program?

Financing for this program may be available through grants, scholarships, loans (federal and private) and institutional financing plans. The median amount of debt for program graduates is shown below:

How long will it take me to complete this program?

The program is designed to take 12 months to complete. Of those that completed the program in 2014-2015, 50% finished in 12 months.

What are my chances of getting a job when I graduate?

The job placement rate for students who completed this program is 68%.

For further information about this job placement rate click here.

Gainful Employment Information

View information about this program, including estimated cost and employment opportunities

Cosmetology/Cosmetologist, General

How much will this program cost me?*

What other costs are there for this program?

For further program cost information click here.

Gainful Employment Information

View information about this program, including estimated cost and employment opportunities

*The amounts shown above include costs for the entire program, assuming normal time to completion. Note that this information is subject to change.

What financing options are available to help me pay for this program?

Financing for this program may be available through grants, scholarships, loans (federal and private) and institutional financing plans. The median amount of debt for program graduates is shown below:

How long will it take me to complete this program?

The program is designed to take 8 months to complete. Of those that completed the program in 2014-2015, 45% finished in 8 months.

What are my chances of getting a job when I graduate?

The job placement rate for students who completed this program is 83%.

This Financial Aid Policies & Procedures Manual is a publication of the Financial Aid Office of John Amico School of Hair Design. Its purpose is to describe the financial aid options available to students through this office as well as provide important information about policies and procedures that may not be covered in the student catalog. In the case of conflicting information between this publication and the student catalog, the student catalog supersedes.

Although this handbook will answer most of your questions relating to financial aid, it is important that students are aware that federal regulations are subject to change which may impact policies and procedures stated in this publication. Students are encouraged to visit the Financial Aid Office for the most current information. General questions can usually be answered on a walk-in basis, but more specific questions may require an appointment.

The John Amico School of Hair Design has endeavored to produce quality cosmetologists who can meet the present and future demands of the beauty industry.

The John Amico School of Hair Design is student-focused and committed to providing each student the knowledge, training, and confidence needed to succeed in the cosmetology profession.

Throughout their training programs, emphasis is placed upon essential salon services and techniques, business strategies such as customer service, client retention, salon retailing, target marketing and people skills.

John Amico School of Hair Design prepares its students to pass their state licensure exam. We are "transforming lives through quality education", thereby equipping our students, future salon professionals, with the tools needed to become successful in their communities.

This institution does not discriminate on the basis of sex, age, race, color, religion, or ethnic origin in admitting students.

In today's market, making a career choice is a very serious undertaking. We at John Amico's School of Hair

Design feel that we can help you make the right choice.

A Cosmetology career offers a motivating and educationally rewarding opportunity for all... whether man, woman, student, homemaker or businessperson.

A career in Cosmetology can also offer rewarding monetary benefits whether you choose to work full or part - time in a salon, as a Teacher, or as a trade technician.

Attached to this catalog is “Cosmetology Career Considerations” which provides more information about the working conditions, hazards, and physical demands of a career in cosmetology.

More information about careers in the beauty industry can be found at the United States Department of Labor's Bureau of Labor Statistics website: www.bls.gov/oco/ocos169.htm.

Q: How much will this program cost me?*

A: Tuition and fees: $10,600

Books and supplies: $1,550

On-campus room & board: not offered

What other costs are there for this program?

For further program cost information click here

* The amounts shown above include costs for the entire program, assuming normal time to completion. Note that this information is subject to change.

Q: What financing options are available to help me pay for this program?

A: Financing for this program may be available through grants, scholarships, loans (federal and private) and institutional financing plans. The median amount of debt for program graduates is shown below:

Federal loans: *

Private education loans: *

Institutional financing plan: *

* There were fewer than 10 graduates in this program. Median amounts are withheld to preserve the confidentiality of graduates.

Q: How long will it take me to complete this program?

A: The program is designed to take 6 months to complete. Of those that completed the program in 2014-2015, *% finished in 6 months

* Fewer than 10 students completed this program in 2014-15. The number who finished within the normal time has been withheld to preserve the confidentiality of the students.

Q: What are my chances of getting a job when I graduate?

A: The job placement rate for students who completed this program is *%.

* We are required to calculate this information; however, there were no graduates in this program for the year 2014-15.

Click here for more information on jobs related to this program 3

Gainful Employment Information

View information about this program, including estimated cost and employment opportunities

Aesthetician/Esthetician and Skin Care Specialist

Q: How much will this program cost me?*

A: Tuition and fees: $6,340

Books and supplies: $1,650

On-campus room & board: not offered

What other costs are there for this program1

For further program cost information click here

* The amounts shown above include costs for the entire program, assuming normal time to completion. Note that this information is subject to change.

Q: What financing options are available to help me pay for this program?

A: Financing for this program may be available through grants, scholarships, loans (federal and private) and institutional financing plans. The median amount of debt for program graduates is shown below:

Federal loans:

Private education loans: *

Institutional financing plan: *

* There were fewer than 10 graduates in this program. Median amounts are withheld to preserve the confidentiality of graduates.

Success:

Q: How long will it take me to complete this program?

A: The program is designed to take 4 months to complete. Of those that completed the program in 2014-2015, *% finished in 4 months.

* Fewer than 10 students completed this program in 2014-15. The number who finished within the normal time has been withheld to preserve the confidentiality of the students.

Q: What are my chances of getting a job when I graduate?

A: The job placement rate for students who completed this program is *%.

* We are required to calculate this information; however, there were no graduates in this program for the year 2014-15.

Click here for more information on jobs related to this program 2

Registration Fee: $150.00

No additional information provided.

Manicurists and Pedicurists

Gainful Employment Information

View information about this program, including estimated cost and employment opportunities

Nail Technician/Specialist and Manicurist

The John Amico School of Hair Design is located at 15301 South Cicero, Oak Forest, Illinois. The School has a Facial room, Clinic Facilities, Theory and Practical Classrooms, Dispensary and Library. The school is well lit, attractively furnished, heated and centrally aired-conditioned for your comfort. Currently, there are no facilities for disabled persons.

Illinois Department of Financial and Professional Regulation

320 W. Washington Street 100 W. Randolph – Suite 9-300

Springfield, Illinois 62786 Chicago, IL 60601 (217) 785-0800 (312) 814-4500 (312) 814-4500

N.A.C.C.A.S. (National Accrediting Commission of Career Arts and Sciences)

4401 Ford Avenue – Suite 1300

Alexandria, Virginia 22302 (703) 600-7600

American Association of Cosmetology Schools (AACS)/Cosmetology Educators of America (CEA)

15825 N. 71st Street - Suite 100

Scottsdale, Arizona 85254 (800) 831-1086

State of Illinois Department of Veterans' Affairs

100 W. Randolph Street – Suite 5-570

Chicago, Illinois 60601-3219- (312) 814-2460

The institution has published student admissions policies that are appropriate for the educational courses and/or program(s), and the institution follows these policies.

1. The institution's admission policies require that each student meet one of the following:

a. *Have a high school diploma, or its equivalent, a transcript showing completion, or a certificate of attainment (only applicable for non-Title IV recipients) certified/verified by the high school's state or other recognized agency; or

b. *Have a state-issued credential for secondary institution completion if home- schooled; or

*High School Diploma Validation Policy

1. Check all "suspicious looking" diplomas against the unacceptable list.

(i.e. no county or state denoted, no seal visible, looks homemade, etc.)

2. If transcript is provided, assure that "standard high school diploma" is stated.

3. If a GED is supplied, assure that the diploma is issued from the state where taken.

4. Military issued GED's are acceptable

5. On-line diploma's or "diploma test only" diplomas are not acceptable.

6. Admissions should report any questionable diplomas to Financial Aid for further evaluation and research.

7. Home educated students who apply for admission as having graduated from a home

education program must meet the minimum requirements stated in Illinois' Compulsory Attendance Law (Section 26-1 of the Illinois School Code) and have proof of registration from ISBE.

c. If enrolled under a training agreement with a government agency, institution district, and/or other entity, meet the admission requirements set out in the training agreement and/or applicable state licensing or certification regulations.

Admissions policy is on pages 7 and 8 of the institution's written catalog which complies with the NACCAS catalog requirements.

2. A limited number of secondary students who are not enrolled under a training agreement as described in item c above (no more than 10% of the number of students currently enrolled) may be admitted if the applicant meets the state requirements for admission, obtains permission in writing from the secondary school in which they are enrolled and successfully completes a pre-enrollment evaluation as established by the institution.

4. During the enrollment process the student will sign forms that they certify they have the institution's catalog.

5. Before enrollment each applicant is provided access to written information that accurately reflects the most recent annual report statistics; all statistical disclosures are included in the course catalog as well as listed on the website. Statistics are updated on both annually.

6. Before enrollment each applicant is provided access to written information that accurately reports the certification or licensing requirements of the jurisdiction for which it is preparing graduates; licensure and graduate requirements are included in the course catalog and forms are signed during the admissions and orientation process to ensure that these documents were received.

7. Before enrollment each applicant is provided access to written information that accurately reports the median loan debt (Title IV, if applicable and non-Title IV) incurred by students who completed each program identified separately. The institution provides the information in accordance with the most recent year as required by the U.S. Department of Education.

All median loan debt disclosures are included in the course catalog as well as listed on the website. Statistics are updated on both annually.

8. The institution uses an enrollment agreement that complies with the NACCAS Enrollment Agreement

Requirements.

9. The enrollment agreement must be fully executed prior to the enrollee starting classes.

10. A copy of the fully executed enrollment agreement is provided to the student and legal guardian, as applicable.

11. A copy of the fully executed enrollment agreement is maintained by the institution.

The institution ensures that each accepted applicant receives a copy of the fully executed enrollment agreement; once a student is accepted into our School we have them sign a signed affidavit which is located at the bottom of the agreement stating as follows:

"I, acknowledge that I have read this contract in its entirety, and that I have received a copy of this contract and all blank spaces have been filled in to my satisfaction. I have also received a copy of the catalog dated . This notice is legally binding when signed by the student and accepted by the school. Any assignee of this agreement takes it subject to all claims and defenses of the Student or his/her successors in interest arising under the agreement. No change or representation in the agreement will be recognized unless made in writing."

The student is given a copy of this agreement upon signing and the original is kept on the front inside page of the student's file.

12. The institution's policies clearly state that the institution does not discriminate on the basis of sex, age, race, color, religion, or ethnic origin in admitting students and can be found on page 5 of the school catalog.

13. The institution has a policy found on page 9 of the school catalog that clearly defines how training or education received at another institution is applied to the receiving institution's course or program requirements for graduation (including the possibility that no such transfer credit is granted).

14. The institution's practices are consistent with its admissions policies and requirements by utilizing a pre- enrollment questioner that is used as a good screening process to be certain that a student not only meets the admissions requirements but also the real world experiences of the life of a Cosmetologist. This helps us identify and encourage those students who not only have the artistic skills and the need to serve need to please attitude but that they also meet the requirements set forth by NACCAS, state and federal regulations. We also maintain a checklist that gets attached to each file. This checklist ensures that each applicant has the proper documentation on file if selected for enrollment. Members of management sit in on interviews time-to-time to evaluate the admissions representative to be certain that the objectives of our school our interpreted in a well-presented and professional manner.

15. Before enrollment, each applicant is provided access to written information that reflects generally known pre requisites for employment and factors that might preclude an individual from obtaining employment in the field for which training is provided such as:

During the enrollment and orientation processes, the student will sign forms that certify they have received this necessary information.

Students may enroll at any time during the year for full time days or part time evening classes. Classes begin periodically as per the annual start date calendar.

1. All students are required to attend an interview at the school and must file an application as far in advance of class starting date as possible.

2. High School Diploma or G.E.D. must be documented, unless the student is in High School and the parents approve and the high school they attend submits a letter of approval to the school.

3. Driver's license (or state I.D.) and social security card are necessary at time of enrollment.

4. Must have a graduated from a licensed school of cosmetology and have a valid cosmetology license if enrolling in the Cosmetology Teacher Training Program.

o Eligibility documented and explained

o Signed award letter

o Entrance counseling completed (*if direct loans accepted)

o Signed Master Promissory Note (studentloans.gov*if direct loans accepted )

o Verification documents in and verified if selected (within 30 days of enrollment)

Prior Training Evaluation

If a student is coming from another licensed beauty school we will only accept a maximum of 1,000 hours. Students coming from another licensed beauty school will be given full credit up to 1,000 hours for all legally acquired hours of previous training (supporting transcript required) as certified by the Illinois Department of Finance and Professional Regulation. Tuition will be based on the total hours of instruction needed to complete the program. Transfer students must have a transcript and agree to complete a minimum of 500 hours of training at John Amico School of Hair Design.

A student wishing to transfer from John Amico School of Hair Design to another licensed beauty school must submit a written request to the school's directors. John Amico School of Hair Design will not release any official transcripts to students unless all financial obligations are met.

Tuition payments are due on a specifically selected day of the month, the 15th of every month. If the student must rely on others for financial resources, they are held responsible for ensuring that their tuition and or their sponsors observe the payment schedule.

The Registration Fee to re-enter a program is $150.00. Registration Fee for a second re-entry is $150.00.

(1500 HOURS)

| Registration Fee 150.00 |

| Books / Equipment Fee 1,950.00 |

| Tuition** 14,999.00 |

| TOTAL $17,099.00 |

** A fee of $10.00 per hour will be charged for every hour over contract ending date.

(1000 HOURS)

| Registration Fee 150.00 |

| Books / Equipment Fee 250.00 |

| Tuition 9,600.00 |

| Total 10,000.00 |

| Credit given for 400 hrs experience (if applicable) (2,000.00) |

| TOTAL $8,000.00 |

** A fee of $9.60 per hour will be charged for every hour over contract ending date.

(750 HOURS)

| Registration Fee 150.00 |

| Books / Equipment Fee 1,550.00 |

| Tuition** 10,600.00 |

| TOTAL $12,300.00 |

** A fee of $14.13 per hour will be charged for every hour over contract ending date.

(350 HOURS)

| Registration Fee 150.00 |

| Books / Equipment Fee 1,150.00 |

| Tuition** 3,700.00 |

| TOTAL $5,000.00 |

** A fee of $10.57 per hour will be charged for every hour over contract ending date.

(600 HOURS)

| Registration Fee 150.00 |

| Books / Equipment Fee 1,738.20 |

| Tuition** 6,340.00 |

| TOTAL $8,000.00 |

** A fee of $10.56 per hour will be charged for every hour over contract ending date.

PRICES SUBJECT TO CHANGE WITHOUT NOTICE.

Financial Aid, Title IV Funding and Fee Waivers:

John Amico School of Hair Design currently participates in the Federal Title IV Funding Program, which includes both PELL Grants and Federal Direct and/or PLUS Loans. We are not currently participating in any other supplemental educational opportunity grant programs.

John Amico School of Hair Design does offer special financial assistance in the form of school scholarships.

John Amico School of Hair Design makes financial award decisions without regard to sex, age, race, color, religion or ethnic origin.

The FERPA is a federal law designed to protect the privacy of a student's education records. The law applies to all schools which receive funds under an applicable program from the U.S. Department of Education.

The FERPA gives certain rights to parents regarding their children's education records. These rights transfer to the student or former student who has reached the age of 18 or is attending any school beyond the high school level. Students and former students to whom the rights have transferred are called eligible students.

** Parents or eligible students have the right to request that a school current records believed to be inaccurate or misleading. If the school refuses to change the records, the parent or eligible student then has the right to a formal hearing. After the hearing, if the school still refuses to make the corrections, the parent or eligible student has the right to place a statement in the records commenting on the contested information in the records.

** Generally, the school must have written permission from the parent or eligible student before releasing any information from a student's record. However, the law allows schools to disclose records without any consent to the following parties:

• School employees who have a need-to-know

• Other schools to which a student is transferring

• Parents when a student over 18 is still dependant

• Certain government officials in order to carry out lawful functions

• Appropriate parties in connection with financial aid to a student

• Organizations doing certain studies for the school

• Accredititing organizations

• Individuals who have obtained court orders or subpoenas

• Persons who need to know in cases of health and safety emergencies

• State and local authorities to whom disclosure is required by state adopted laws before

November 19, 1974

Schools may also disclose, without consent, "directory" type information such as student's name, address, telephone number, date and place of birth, honors and awards, and dates of attendance. However, the school must tell parents and students of the information that is designated as directory information and provide a reasonable amount of time to allow the parent or eligible student to request the school not to disclose that information about them. Schools must notify parents and eligible students of their rights under this law. The actual means of notification is left to each school. If you wish to see your records, you should contact the school for the procedure to follow.

Any questions or concerns under this act should be directed to: Family Policy Compliance Office, Department of Education, 400 Maryland Ave SW, Room 3017, Washington D.C. 20202-4605 or you may call (202) 401-2057.

In accordance with the Crime Awareness and Campus Security Act of 1990, the school collects crime statistics as the basis for this Annual Security Report, which is made available to students, employees and applicants for enrollment or employment. Campus is defined as "any building or property owned or controlled by the school within the same area used by the school in direct support of, or related to, its educational purposes." The following criminal offenses occurred on campus during the twelve-month period of August 1, 2014 through July 31st, 2015.

| TYPE OF CRIME | OCCURRENCES | ARRESTS | |

| Murder | 0 | 0 | |

| Sex Offenses | 0 | 0 | |

| Robbery | 0 | 0 | |

| Aggravated Assault | 0 | 0 | |

| Burglary | 0 | 0 | |

| Motor Vehicle Theft | 0 | 0 | |

| Weapons Possession | 0 | 0 | |

| Liquor Law Violations | 0 | 0 | |

| Drug Abuse Violations | 0 | 0 |

The school encourages all students and employees to be responsible for their own security and the security of others. Please report any known criminal offense occurring on campus to the school administration. In the event a sex offense should occur on campus, the accuser should take the following steps:

1. Report the offense to the school administration.

2. Preserve any evidence as may be necessary to the proof of criminal sexual assault.

3. Request assistance, if desired, from school administration in reporting the crime to local law enforcement agencies.

4. Report the crime to local law enforcement agencies.

5. Request a change in the academic situation if desired.

All campus disciplinary action in cases of alleged sexual assault will be based on the finding by the law enforcement agency investigation, the facts pertaining to the crime, and other related mitigating circumstances.

o Cut finger: Educator should immediately check the wound to see how deep the cut is. Small cuts should be washed, dried, and then covered with a bandage. Bandages and first aid kits are kept in the dispensary and in the Student Services office.

o Cuts requiring stitches: If possible, a staff member should take the student to the doctor.

Proceed as follows:

— Students in the main salon area, exit single file out the front doors. If you have a client at the time, the client is your responsibility. After exiting from the school, proceed into the parking lot away from the building.

— Students in back salon area or Casablanca room file out the back emergency exit door in dryer area. If you have a client at the time, the client is your responsibility. After exiting from the school, proceed into the parking lot away from the building.

— Receptionists at the front desk will help clients in the reception area out the main doors. Proceed into the parking lot.

— Students in the upper-level classroom exit through the rear classroom emergency door in single file. Proceed into the parking lot away from the building.

— Students in the lower-level classrooms or lunchroom exit through the emergency exit door located in the lunch/show room in single file. Proceed up the stairs and into the parking lot away from the building

o Proceed as follows:

— Students and clients in the styling area will walk to the classrooms or restrooms. Be seated on the floor making space available for others.

— Students in classrooms- remain there.

A conviction related to a drug offence could cause a student to lose Title IV Financial Aid eligibility.

Health risks associated with the use of illicit drugs and the abuse of alcohol include:

— Impaired mental and physical health

— Neurological disease/damage

— Memory or intellectual performance interference

— Mental and physical depression

— Uncontrollable violence

— Impulsive behavior

— Convulsive seizures

— Homicide

— Suicide

— Cardiac disease/damage

— Cardiovascular collapse/heart failure

— Gastrointestinal disease/damage

— Ulcers/erosive gastritis

— Anemia

— Liver and pancreatic disease

— Liver failure/pancreatitis

— Deteriorating relationships

— Overdose

— Death

John Amico School of Hair Design upholds standards of conduct that prohibit the unlawful possession, use or distribution of illicit drugs and alcohol by students both on our property and as part of any of our activities. The school will immediately contact law enforcement officials to report such activities.

The School believes that the health risks of the use of illicit drugs and alcohol abuse require providing education and referral services for students involved. The School will provide such education annually and will refer students when necessary.

Area drug abuse information, counseling, referral and treatment centers will be provided upon request. The School may expel students involved in unlawful possession, use or distribution of illicit drugs and/or alcohol. The School will refer such cases to the proper authorities for prosecution. Students may be reinstated upon completion of an appropriate rehabilitation program.

There are serious legal sanctions for illegal use of drugs and/or alcohol. There are also serious health risks associated with such use.

The 1998 Higher Education Act Mandatory Good Fair Effort for the National Voter Registration Act. It reads, in part, "The institution will make good faith effort to distribute a mail voter registration form, requested and received from the State, to each student enrolled in a degree or certificate program and physically in attendance at the institution, and to make such forms widely available to students at the institution." The State of Illinois has provided the following link for students to use to print a voter registration form:

http://www.elections.state.il.us

http://www.elections.il.gov/votinginformation/welcome.aspx

English Voter Registration Form: http://www.elections.state.il.us/Downloads/VotingInformation/PDF/R-19.pdf

Spanish Voter Registration Form: http://www.elections.state.il.us/Downloads/VotingInformation/PDF/R-19Spanish.pdf

Evaluations of satisfactory progress are made at scheduled intervals for all students who are under individual contract. Students meeting minimum requirements at evaluation will be considered making satisfactory progress until the next scheduled evaluation. In order for a student to be considered making satisfactory progress, the student must meet both attendance and academic minimum requirements.

A student is considered to be in satisfactory progress if he/she maintains an attendance pace of at least 67%, maintains a grade average of 75% or better on each theory and practical test, and keeps all practical work current with accrued hours. Attendance pace is defined as a percentage of the cumulative number of hours attended by the student divided by the cumulative number of hours attempted/scheduled. Students maintaining a cumulative attendance pace of at least 67% will ensure program completion within the required maximum time frame. The maximum time frame for program completion is 150% of the program length, or the contracted hours in the enrollment agreement, whichever is less. Students are also expected to complete the program within a maximum calendar time frame of 17 months for full time students or 31 months for part time students. "Maximum time frames for program completion are subject to change based on changes in attendance schedules." Maximum time frames exclude any periods of approved leaves of absence; equal to the length of the actual approved leave. In addition Satisfactory Academic Progress evaluations will not include any scheduled hours for the time period the student is on an approved Leave of Absence.

All students are considered in satisfactory progress from the time they begin classes until their first scheduled evaluation.

Students will be evaluated the following periods and must achieve minimum GPA and attendance requirements to be considered to having satisfactory progress at the following actual hours attended:

Cosmetology Program: 450, 900, 1200 and 1500 hours

Cosmetology 1000 hour Teacher Training Program: 450 hours and 900 hours

Cosmetology 600 hour Teacher Training Program: 300 hours

In the case of a student that enters with transfer hours from another institution, the transfer hours that are accepted are counted as both attempted and completed hours for the purpose of determining when the student will reach allowable maximum time frame. Satisfactory Academic Progress evaluations will be based on actual contracted hours at the institution.

Students will remain eligible for Federal Aid only if they are making satisfactory progress, are on financial aid warning, or are on probation as a result of a written appeal as later described in this policy.

If a student does not meet one or both of the criteria at an evaluation point, he/she will automatically be placed on "Financial Aid Warning" for the next payment period during which the student will remain eligible for federal aid. The student will be notified with a written report in a meeting with the Director of Financial Aid. In addition to being placed on Financial Aid Warning;, the students funds with be disbursed at the schools discretion within the payment period based on relevant information provided by the student as to why he/she did not meet the criteria. The student may be asked to become current on required tests and/or assignments before the funds are disbursed. A student will not be granted consecutive warning statuses.

If the student fails to meet satisfactory progress in either area after the "Financial Aid Warning" period, then the student will be considered as not making satisfactory progress and will become ineligible for further federal aid. A student may appeal this determination for reconsideration by the institution based on certain conditions including, but not limited to: family death, student illness, illness to a family member requiring the student to become a care giver, loss of a parent or guardian requiring the student to take care of sibling or family members or significant extenuating circumstances. The student's appeal must be made in writing and must include detailed information regarding why the student failed to maintain satisfactory progress during his/her enrollment as well as what conditions have changed for the student, and how the student expects to meet the school's satisfactory progress standards. If the institution approves the appeal, the student may be placed on probation for one additional payment period during which the student remains eligible for federal aid. In regards to probation, the student must appeal and meet one of the following: a) be able to mathematically meet Satisfactory Academic Progress by the next evaluation period or b) be placed on an academic plan to regain satisfactory academic progress status. To continue to be eligible for federal aid beyond the probationary period, the student must either be meeting the cumulative attendance and grade standards as published by the school, or be in compliance with any customized written academic plan. Students failing to meet either of these conditions are no longer eligible for federal financial aid and are also subject to termination from the school. All documents concerning a written appeal of a Satisfactory Academic Progress evaluation must be kept in the student file, including the schools written determination of such appeal and details of any academic plan that may be developed.

To re-establish satisfactory progress, a student must improve his/her attendance or academic average, or both, to the designated standards of the checkpoint schedule described above.

A student whose training has been interrupted due to unsatisfactory progress may apply for re-admission to the school after a period of six months. The institution will consider the student's application for re-admission and will consult with the student, if necessary. A decision will be made regarding the student's re-entry and his/her ability to resume training and regain eligibility for federal aid. The institution's decision is final. Except as otherwise stated herein, the institution does not permit course incompletes or repetitions. Accordingly, these conditions have no effect on satisfactory progress. Students who previously withdrew from school who re-apply for acceptance shall return to school with the same satisfactory progress status as was in place at the time of withdrawal.

All grades, services and hours are recorded and kept on file for a minimum of five years.

An official transcript and school records for students who withdrew or dropped out of a program shall be maintained by the school for 7 years from the student's first day of attendance at the school.

Occasionally, students may experience extended personal, medical or other problems, which make it difficult to attend school. John Amico School of Hair Design may allow a student under such circumstances to take a leave of absence (LOA) that will temporarily interrupt their training. A request for leave of absence must be submitted in advance, unless unforeseen circumstances prevent the student from doing so. A leave of absence will interrupt any financial assistance. The time for a leave of absence will be considered on an individual basis but cannot exceed 180 days in a twelve-month period.

Students who fail to return to school at the end of a leave of absence will be considered withdrawn from the program. A refund calculation will be applied based on the hours accrued as of the last day of physical attendance at school.

(pertains to both Voluntary and Involuntary Dismissals)

The termination date for refund computation is the last date of actual attendance by student

The school uses and institutional refund calculation form and this policy is set in place for ALL terminated and withdrawn students regardless if they are a Title IV recipient. If a Title IV recipient withdraws or is terminated before the completion of a Title IV payment period, a calculation of Title IV funds will be completed and any applicable returns by the school shall be paid first to Financial Assistance Source, second Scholarships and last to the student. After the applicable Title IV returns are made, the institutional refund calculation will determine the amount earned by the school and owed by the student.

In the event a student withdraws or is terminated from the program, a tuition refund calculation in accordance with our institutional refund policy will be performed and any resulting refunds must be repaid by the school. For Title IV recipients, a Return of Unearned Title IV Funds calculation must be performed before an institutional refund calculation. Any unearned Title IV funds must be returned to the federal aid account within the regulatory 45-day deadline. When returning unearned Title IV funds, or making tuition refunds, the money will be returned in the following mandated order:

• To unsubsidized, then subsidized Federal Direct Loan Programs.

• To the Federal Pell Grant Program

• To any other Title IV Program

RETURN TO TITLE IV (R2T4) PAPERWORK

This form is used to determine the amount of federal student funds that must be returned to the Title IV program on the school's behalf. The Financial Aid Administrator will complete this form, and send it to the third party processor. The third party processor will review the form and inform the school of the results.

RETURNING FUNDS TO THE DEPARTMENT OF EDUCATION

If the R2T4 form determines that the school must return federal money, the Accountant transfers the money back into the school's federal account. The third party processor is informed of the amount and date that the money was transferred back into the federal account.

2. INSTITUTIONAL REFUND POLICY

For a student who enrolls in and begins classes, the following schedule of tuition adjustments is authorized (registration fee, books, and equipment fees as indicated on the Addendum are charged in addition to the following refund computation). See addendum for actual cost of non-refundable items.

Percentage Time to Total Time of Course Amount of Total Tuition owed to the School

0.01% to 4.9% = 10% (or $300 + fees, whichever is less)

5% to 9.9% = 30%

10% to 14.9% = 40%

15% to 24.9% = 45%

25% to 49.9% = 70%

50% and over = 100%

Effective December 1, 2012 enrollment time is defined as the time elapsed between the actual starting date and the date of the student's last day of physical attendance in the school and the number of hours which should have been completed at that point. Formal termination shall occur no more than 15 school days from the last day of physical attendance.

A student shall give notice of cancellation in writing to the student services office. The date of cancellation shall be the last day of attendance. The School shall mail a written acknowledgment of a student's cancellation or written withdrawal within 15 calendar days of the postmark date of notification. Any remaining refund would be made to the student within 30 days after the student's withdrawal from school.

Unexplained absence from school for more than 15 school days or not returning from an official leave of absence after 180 days shall constitute notice of cancellation. The date of cancellation shall be the last day of attendance. The School shall mail a written acknowledgment of a student's cancellation or written withdrawal within 15 calendar days of the postmark date of notification. Any remaining refund would be made to the student within 30 days after the student's withdrawal from school.

• If John Amico School of Hair design is permanently closed and no longer offering programs after a student has enrolled, the student shall be entitled to a pro-rata refund of tuition.

• If a course is cancelled subsequent to a student's enrollment, the school shall at it option:

(1) provide a full refund of all monies paid; or

(2) provide completion of the course.

• Any monies due to the student shall be refunded within 30 days of formal cancellation by the student.

• Any monies due to the school must be paid within 30 days after cancellation or termination.

• Example of grounds for termination are violence, drug or alcohol use, forgery and stealing.

• Student transcripts of hours will not be released until all tuition obligations have been met.

• In case of illness, or disabling accident, death in the immediate family, or other circumstances beyond the control of the student, the school can make a settlement, which is reasonable and fair to both.

• Refunds shall be made in this order: (1) Financial assistance, (2) source Scholarship,(3) Student.

• If a student is allowed to re-enter at the discretion of the school a $150 re-entry fee plus current charges.

* No responsibility is assumed by the School for any negligence, carelessness, or lack of skill by one or more students while practicing any part of the School course upon another.

* No change or representation in the contract will be recognized unless made in writing.

* If the school transfers any contract or interest in the contract to another party, the student has the same rights afforded to him or her by the transferee as by the transferor.

* "Buyer's right to cancel" (in writing) until midnight of the 5th business day after enrollment.

Complaints against this school may be registered with the Department of Financial and Professional

Springfield Chicago

320 W. Washington Street 100 W. Randolph – Suite 9-300

Springfield, IL 62786 Chicago, IL 60601

217-785-0842 312-814-4500

The institution uses a refund policy which meets all policies provided by both NACCAS and the Federal Government. The institution participates in the Title IV Pell Grant program and uses the correct Return to Title IV Calculation forms in conjunction with the Institutional Refund Calculation.

The school uses and institutional refund calculation form and this policy is set in place for ALL terminated and withdrawn students regardless if they are a Title IV recipient. If a Title IV recipient withdraws or is terminated before the completion of a Title IV payment period, a calculation of Title IV funds will be completed and any applicable returns by the school shall be paid first to Scholarships, second the

Federal Pell Grant program and last to the student. After the applicable Title IV returns are made, the institutional refund calculation will determine the amount earned by the school and owed by the student.

The School uses an institutional refund calculation form which follows the state guidelines, and also meets NACCAS cancelation and settlement policy and minimum refund guidelines.

Source: Department of Education: - The Guide to Federal Student Aid

To receive aid from federal student aid programs you must meet certain criteria.

Except for some loan programs, you must show that you have financial need according to the Department of Education requirements. (See "Financial need and Expected family Contribution".)

You must demonstrate by one of the following means that you are qualified to enroll in postsecondary education:

You must be enrolled or accepted for enrollment as a regular student working toward a degree or certificate in an eligible program.

You must meet satisfactory academic progress standards set by the postsecondary school you are or will be attending.

You might be able to receive aid for distance education courses as long as they are part of a recognized certificate or degree program.

Students with intellectual disabilities can receive federal student aid under the Federal Pell Grant

Program, FSEOG Program and Federal Work-Study Program. To be eligible, you must:

A comprehensive transition and postsecondary program for students with intellectual disabilities means a degree, certificate, or non-degree program that

If your parent or guardian died as a result of military service in Iraq or Afghanistan after September 11, 2001, you may be eligible for aid if, at the time of the parent's or guardian's death, you were less than 24 years of age or enrolled at least part-time at an institution of higher education. Payments are adjusted if you are enrolled less than full-time.

Even if you're ineligible for federal student aid because of a drug conviction, you should still complete the FAFSA because most schools and states use FAFSA information to award nonfederal aid. If you have lost federal student aid eligibility due to a drug conviction, you can regain eligibility if you pass two unannounced drug tests conducted by a drug rehabilitation program that complies with criteria established by the U.S. Department of Education.

When you apply for federal student aid, the Department of Education verifies some of your information with certain federal agencies, including the Social Security Administration (for verification of Social Security numbers and U.S. citizenship status) and the Department of Homeland Security (to verify Alien Registration numbers). If the information doesn't match, the discrepancy must be resolved before you can receive federal student aid. They also check your information against our National Student Loan Data System (NSLDS), to verify that you haven't defaulted on your federal student loan, haven't received an overpayment on a federal grant or a Federal Perkins Loan and haven't borrowed more than the total limit allowed. They also check your information against Veterans Affairs if you answer that you are a veteran. Most males between the ages of 18 and 25 must register with Selective Services in order to be eligible for federal student aid, so we check with this agency as well.

Aid for most of the Department of Education's programs is awarded based on financial need (except for unsubsidized Direct Loans, PLUS Loans and TEACH Grants). The EFC is a measure of your family's financial strength and resources that should be available to help pay for your education.

The EFC is calculated from the information you report on the FAFSA and according to a formula established by law. Your family's income (taxable and untaxed) and assets are considered in determining your EFC. Your family size and the number of family members who will be attending a college or career school are also considered. Your EFC will appear on the Student Aid Report (SAR) you receive after you file your FAFSA. To determine your financial need for federal student aid programs (except for unsubsidized Direct Loan), you school subtracts the Expected Family Contribution (EFC) from your cost of attendance.

The school uses federal grants and other financial aid to meet your financial need. Because the EFC formula must be applied to each family's financial information, we cannot tell you here whether you will be eligible for federal student aid or estimate how much aid you might receive. If you'd like to get an estimate of your financial aid award use FAFSA4caster at www.fafsa4caster.ed.gov. The information you submit with FAFSA4caster can be used to populate some of your FAFSA on the Web when you're ready to apply for aid. But remember to find out exactly what you will be eligible to receive you must apply for financial aid. If you want to see how the EFC formula works, you can get detailed worksheets from our website at www.FederalStudentAid.ed.gov/pubs. Click on the year under the "EFC formula" or you can call the Federal Student Aid Information Center at 1-800-4-FED-AID (1-800-433-3243).

After you receive your SAR, you will also receive an award letter from the school(s) listed on your FAFSA that offers you admission. Contact the financial aid office at the school(s) that sent you an award letter if you have any questions about your student financial aid award.

The EFC formula is basically the same for all applicants, but there is some flexibility. Your financial aid administer (FAA) can adjust the cost of attendance or the information used to calculate your EFC to take into account your unusual circumstances. These circumstances could include your family's unusual medical expenses, tuition expenses or unemployment. The FAA must have good reasons to use professional judgment to make adjustments because of unusual circumstances. You will have to provide documentation to support any adjustments. For example, for the 2014-2015 award year, financial aid administrators may use a letter from the state unemployment agency or other evidence that a student is receiving unemployment benefits to document the loss of income from work. The FAA's decision as to whether to make changes is final and cannot be appealed to the Department of Education.

The following are several additional examples of unusual circumstances that the FAAs may consider as factors in making adjustments in the expected family contribution calculation or to the cost of attendance. These examples are:

Source: Department of Education: - The Guide to Federal Student Aid

Federal Pell Grant Lifetime Eligibility calculator (updated 01/2014)

The maximum amount of Federal Pell Grant funding a student can receive is calculated for an award year. An award year is a period from July 1 of one calendar year to June 30 of the next year.

The scheduled award is partially determined using the student's expected family contribution (EFC), which the program calculates from the information the student and family provided in the Free Application for Federal Student Aid (FAFSA). The result is the maximum amount the student can receive for the award year if enrolled full-time for the full school year. It represents 100% of the Pell Grant eligibility for that award year.

Percent used: To determine how much of the maximum six years (600%) of Pell Grant the student uses each year, the U.S. Department of Education (ED) compares the actual amount awarded for the award year with the scheduled award amount for that award year. A student who uses 100% receives the full award. A student might not receive the entire scheduled award for an award year. A number of things can cause this-most commonly, the student didn't enroll for the full year, did not enroll full-time, or both. If the student doesn't receive the full award, ED calculates the percentage of the scheduled award they did receive.

o Your EFC (Expected Family Contribution).

o Your cost of attendance.

o Whether you're a full-time or half-time student.

o Whether you attend school for a full academic year.

o Your Social Security number and your parents' Social Security numbers, if you're a dependent student.

o Your driver's license number (if any).

o W-2 forms and other records of money earned (by you and by your parents, if you're a dependent student).

o Your Federal Income Tax Return (and that of your spouse, if you're married).

o Your parents' Federal Income Tax Return (if you're a dependent student).

o Any foreign tax return or tax return from Puerto Rico.

o Your untaxed income records-examples include IRA deductions, child support, and veteran's non-educational benefits.

o Your current bank statements, business and investment mortgage information; business and farm records; and stock, bond and other investment records.

o Your alien registration number (if you are not a U.S. citizen).

If possible, have the necessary income tax returns finished so you can complete the FAFSA more easily and accurately. If you apply before your tax return has been completed, you'll have a two-step application process.

o Step 1 - Apply and estimate your income and tax information on your application.

Step 2 - Make corrections later if your estimated income or tax information was not accurate.

You cannot receive federal student aid unless all of your information is complete and accurate.

o "Sign" your FAFSA electronically and complete the student aid process completely online-no paper is involved. If you're a dependent student and one of your parents has a Federal Student Aid PIN, he or she can sign your FAFSA electronically online as well.

o Correct your FAFSA online.

o Access your Student Aid Report (SAR).

o "Sign" a master promissory note for a federal student loan.

o Access your federal student aid records online, including your student loan history information on NSLDS.

Source: Department of Education: - The Guide to Federal Student Aid

Student loans, unlike grants and work-study, are borrowed money that must be repaid, with interest, just like car loans and home mortgages. You cannot have these loans canceled because you didn't like the education you received, didn't get a job in your field of study or you're having financial difficulty. Loans are legal obligations, so before you take out a student loan, think about the amount you'll have to repay over the years. To learn more about Federal student loan debt, read Your Federal Student Loans: Learn the Basics and Manage Your Debt. You can find this publication atwww.studentaid.ed.gov/repayingpub.

Loans made through this program are referred to as Direct Loans. Eligible students and parents borrow directly from the U.S. Department of Education at participating schools. Direct Loans include subsidized and unsubsidized Direct Loans (also known as Direct Subsidized Loans and Direct Unsubsidized Loans), Direct PLUS Loans, and Direct Consolidation Loans. You repay these loans directly to the Department of Education.

What is the interest rate on these loan?

Subsidized Direct Loans made to undergraduate students with a first disbursement date between July 1, 2014 and June 30, 2015 have a fixed interest rate of 4.66% (see the chart below for information on future interest rate reductions). Unsubsidized Direct Loans made to graduate students have a fixed interest rate of 4.66%. Direct PLUS Loans have a fixed interest rate of 7.21%.

These interest rate reductions do not affect the interest rates of any prior Subsidized Direct Loans made to undergraduate borrowers; the interest rates on those prior loans remain unchanged.

How do I apply?

o Your Social Security number and your parents' Social Security numbers, if you're a dependent student.

o Your driver's license number (if any).

o W-2 forms and other records of money earned (by you and by your parents, if you're a dependant student).

o Your Federal Income Tax Return (and that of your spouse, if you're married).

o Your parents' Federal Income Tax Return (if you're a dependent student).

o Any foreign tax return or tax return from Puerto Rico.

o Your untaxed income records-examples include IRA deductions, child support, and veteran's non-educational benefits.

o Your current bank statements, business and investment mortgage information; business and farm records; and stock, bond and other investment records.

o Your alien registration number (if you are not a U.S. citizen). If possible, have the necessary income tax returns finished so you can complete the FAFSA more easily and accurately. If you apply before your tax return has been completed, you'll have a two- step application process.

o Step 1-Apply and estimate your income and tax information on your application.

o Step 2-Make corrections later if your estimated income or tax information was not accurate.

You cannot receive federal student aid unless all of your information is complete and accurate.

o "Sign" your FAFSA electronically and complete the student aid process completely online-no paper is involved. If you're a dependent student and one of your parents has a Federal Student Aid PIN, he or she can sign your FAFSA electronically online as well.

o Correct your FAFSA online.

o Access your Student Aid Report (SAR).

o "Sign" a master promissory note for a federal student loan.

o Access your federal student aid records online, including your student loan history information on NSLDS.

Entrance Counseling: To get a Direct Loan, you must complete entrance counseling which covers the following topics:

o Written information on loan obligations and information on rights and responsibilities as a borrower.

o A grace period and an explanation of what this means.

o A disclosure statement, received before the student begins to repay their loan, that includes information about interest rates, fees, the balance owed, and the number of payments.

o Deferment of repayment or forbearance for certain defined periods, if student qualifies and if students requests deferment or forbearance.

o Prepayment of student loan in whole or in part anytime without an early- repayment penalty.

o A copy of student's MPN either before or at the time the student's loan is disbursed.

o Documentation that the student's loan has been paid in full.

o Completing exit counseling before the student leaves school or drops below half- time enrollment.

o Repaying the loan even if the student does not complete the academic program, student is dissatisfied with the education received, or student is unable to find employment after graduation.

o Notifying the school and the Direct Loan Servicing Center if the student:

— Moves or changes his/her address

— Changes his/her name

— Withdraws from school or drops below half-time enrollment

— Transfers to another school

— Fails to enroll or reenroll in school for the period in which the loan was intended

— Changes his/her expected graduation date

— Graduates

o Making monthly payments on the loan after the grace period ends, unless there is a deferment or forbearance and repayment options will be provided during exit counseling.

o Notifying the Direct Loan Servicing Center of anything that might alter eligibility for an existing deferment or forbearance.

Entrance Counseling can be completed at the following website: www.studentLoans.gov orhttp://mappingyourfuture.org/

Exit Counseling: To get a Direct Loan, you must complete entrance counseling which covers the following topics:

o Written information on loan obligations and information on rights and responsibilities as a borrower.

o A grace period and an explanation of what this means.

o A disclosure statement, received before the student begins to repay their loan, that includes information about interest rates, fees, the balance owed, and the number of payments.

o Deferment of repayment or forbearance for certain defined periods, if student qualifies and if students requests deferment or forbearance.

o Prepayment of student loan in whole or in part anytime without an early- repayment penalty.

o A copy of student's MPN either before or at the time the student's loan is disbursed.

o Documentation that the student's loan has been paid in full.

o Completing exit counseling before the student leaves school or drops below half- time enrollment.

o Repaying the loan even if the student does not complete the academic program, student is dissatisfied with the education received, or student is unable to find employment after graduation.

o Notifying the school and the Direct Loan Servicing Center if the student:

— Moves or changes his/her address

— Changes his/her phone number

— Changes his/her name

— Changes in employer or employer's address or telephone number

o Making monthly payments on the loan after the grace period ends, unless there is a deferment or forbearance and repayment options will be provided during exit counseling.

o Notifying the Direct Loan Servicing Center of anything that might alter eligibility for an existing deferment or forbearance.

Exit Counseling can be completed at the following website: www.NSLDS.ed.gov orhttp://mappingyourfuture.org/

To get a Direct Loan, you must sign a Master Promissory Note (MPN). The MPN is a legally binding agreement that you will replay your loan to the Department. It contains the terms and conditions of the loan and explains how and when it must be repaid. You should keep the MPN and any other loan documents in a safe place for future reference.

The MPN can be used to make all of your Direct Loans during your college attendance (for up to 10 years), if your college chooses to use it to make multiple loans. For example, you could sign one MPN and receive a subsidized and unsubsidized loan for your first year as well as your second year of study. You'll receive a disclosure statement that gives you specific information about any loan that the school plans to disburse under your MPN, including the loan amount and loan fees. This disclosure statement also tells you how to cancel your loan if you don't want it.

John Amico School of Hair Design uses the electronic Master Promissory Note (e-MPN). In order to complete this, students will be directed to: studentloans.gov

There are several types of financial assistance that you can apply for at John Amico School of Hair Design. All assistance is determined by eligibility. First, we recommend completing and submitting your FAFSA for Federal financial aid. Then, review the information below and meet with the Financial Aid Administrator to determine any additional assistance for which you may be eligible.

FAFSA

Filling out the Free Application for Federal Student Aid (FAFSA) is the first step in securing financial aid. All students must complete this in order to obtain any federal aid, regardless of the financial status of the family. This will determine your eligibility for a wide range of financial aid.

There is a year-end deadline of June 30th to complete the FAFSA. We encourage all students to apply early in order to ensure you receive your disbursements within a reasonable time.

To ensure we are able to properly process your FAFSA, make sure your completed FAFSA includes John Amico School of Hair Design's School Code: 041874 (Cosmetology Concepts). This code will be used by the federal processor to ensure we receive your FAFSA results, which will determine your federal aid eligibility. To ensure accuracy, whenever possible, use income and other information from your completed tax return, rather than estimated figures. Once your FAFSA results are received by John Amico School of Hair Design, you will be awarded financial aid, according to your eligibility.

You can find more information, or apply for financial aid by visiting the FAFSA website at:http://www.fafsa.ed.gov/.

GRANTS

Grants are aid that you do not have to repay and are usually based on financial need. By completing the FAFSA, you will automatically be considered for the Federal Pell Grant. This grant is awarded to undergraduate students with the lowest Expected Family Contribution (EFC). The award amount may change annually and varies depending on enrollment status (full-time/ part-time). If a student withdraws while receiving a Pell grant, the award amount may be adjusted. You can learn more about the Federal Pell Grant by scheduling a meeting with the Financial Aid Administrator or visiting the federal website at: http://www2.ed.gov/programs/fpg/index.html.

Unlike grants and scholarships, loans are a type of financial assistance that must be repaid. Loans come with interest that must also be repaid, so it is important to research and weigh your options carefully before borrowing, and borrow conservatively. Federal loans usually have lower interest rates and better benefits than private loans. We strongly encourage students to maximize federal loan eligibility before considering private loan options. By completing the FAFSA, you will automatically be considered for federal loan programs available at John Amico School of Hair Design. More information on the federal loan programs available at John Amico School of Hair Design can be found below.

The William D. Ford Federal Direct Loan is a fixed interest loan. Students cannot borrow more than the estimated cost of attendance, meaning the loan cannot exceed the standard budget for the institution. In addition to these need and budget limitations, a federal maximum also applies. To be eligible for a Federal Direct Loan, a student must be enrolled at least half time and meet institutional satisfactory progress standards. In addition, a student must complete the financial aid process in order to be eligible.

There are two types of Federal Direct Loans: subsidized and unsubsidized.

Subsidized loans are available to students who demonstrate financial need after applying all grants, scholarships and other applicable resources. If a student's financial need is met through grants, scholarships and other applicable resources, the student will not receive a subsidized loan.

No interest will accrue on a subsidized loan while the student is in school or for the first six months after they leave school. Recipients of these loans may also apply for periods of deferment after leaving school if low income or hardships prevent repayment.

Unsubsidized loans are also available through the Federal Direct Loan program. These loans are non- need based. Unlike the subsidized loans, the student is responsible for interest that accrues while the student is attending school. Students have the option of paying the interest while in school or letting it capitalize until they begin making payments on the principal. Choosing to let it capitalize will increase the total amount that must be repaid.

Upon completion of the FAFSA and any other paperwork that may be required, the financial aid office will meet with each student informing the student of the award amount available. The student will be able to discuss the award with the Financial Aid administrator. (A student can request to take a portion or all of the amount awarded, but is not able to request more than what was awarded.) A 1.072% federal loan origination fee will be deducted from each disbursement.

The student will also be informed of any additional steps that must be completed prior to obtaining any disbursements. If a student needs assistance completing any of these steps, the student can schedule an appointment with the Financial Aid Administrator who will assist the student.

In addition to meeting with the Financial Aid Administrator, the student must also complete the required entrance loan counseling prior to receiving any disbursements. This is a one-time requirement and must be completed in advance by selecting the Federal Direct Loan Entrance Counseling link onhttp://mappingyourfuture.org/

The student is required to complete the quiz using their name, social security number and date of birth. Once the student has completed the quiz, the results will be electronically available to the Financial Aid Administrator, who will then print the form and place it in the student's file.

It is required that all Direct Loan Borrowers complete entrance loan counseling, even if the borrower has had loan counseling at another institution.

In addition to meeting with the Financial Aid Administrator and Entrance Loan Counseling, the student must also complete a Master Promissory Note prior to receiving any disbursements. This must be completed in advance and can be completed through the Master Promissory Note link on the Direct Loan website at: www.studentloans.gov. It is recommended to turn off all pop-up blockers to enable successful completion of the Master Promissory Note.

In order to complete the Master Promissory Note, the student will need their Federal PIN, driver's license (or state ID) number, and the names and addresses of two personal references from two different households.

Students are asked to read the Borrowers Rights and Responsibilities Statement provided by the Federal Direct Loan Program. This statement details the terms of the student's loan. Students are able to obtain this statement at: http://www2.ed.gov/offices/OSFAP/DirectLoan/dlrights.pdf.

Upon completion of all of these steps, the student will receive a "Disclosure Statement" from the Direct Loan Servicing Center. This statement will list the disbursements to be made to the student. It is important that the student keeps this for their records.

If a student who was awarded a Direct Loan withdraws, drops below half-time enrollment, or graduates, the student must complete exit loan counseling. The exit counseling can be completed online through the Direct Loan website at: www.nslds.ed.gov or at http://mappingyourfuture.org/. The exit counseling will provide the student important information regarding repaying their loan, deferment, loan cancellation and consequences that may occur due to student loan default.

After completing this counseling the Financial Aid Administrator must print the electronic confirmation and place it in the student's file. Please contact the Financial Aid Office if you have questions in regards to exit loan counseling.

Subsidized and Unsubsidized Federal Loan information will be submitted to the National Student Loan Database System. This system is accessible by guaranty agencies, lenders, borrowers and institutions determined to be authorized users of the data system.

Federal Direct Parent Plus Loan

The Federal Direct Parent PLUS Loan for Undergraduate Students, often called PLUS, is non-need based. It is a fixed interest rate loan for the parents of dependent students. Amounts of the loan are limited by the institutional budget less other financial aid the student has received.

The Direct PLUS loan offers a 7.21% fixed interest rate (2014-2015) on the loan and the repayment on the loan begins

60 days after the loan is fully disbursed. The loan cannot be transferred into the student's name; the parent borrower must repay the loan.

In order for a parent to be eligible for a PLUS loan, their dependent student must maintain at least half- time enrollment and is required to meet Satisfactory Academic Progress.

After completing the FAFSA, if a parent wants to take out a PLUS loan, the parent must apply. Either the student or the parent can apply by contacting the Financial Aid Administrator and obtaining a Consent to Obtain Credit form. Once approved for the PLUS loan, the parent will be required to complete their own Master Promissory Note (separate from the one completed by the student).

This must be completed in advance and can be completed through the Master Promissory Note link on the Direct Loan website at: www.studentloans.gov. It is recommended to turn off all pop- up blockers to enable successful completion of the Master Promissory Note.

In order to complete the Master Promissory Note, the parent will need their Federal PIN, driver's license (or state ID) number, and the names and addresses of two personal references from two different households.

Parents are not required to complete Entrance or Exit Counseling when taking PLUS loans.

After deducting any funds necessary for tuition or fees owed to the institution, PLUS loans are disbursed directly to the parent.

The Federal Direct PLUS loan will enter repayment 60 days after the final disbursement. All repayment and deferment questions can be answered by the Direct Loan Servicing Center at (800) 848-0979.

PLUS Loan information will be submitted to the National Student Loan Database System. This system is accessible by guaranty agencies, lenders, borrowers and institutions determined to be authorized users of the data system.

Veterans or children of Veterans may be eligible for educational benefits based on U.S. military service. You can find more information, or apply for these benefits at: http://www.va.gov/ or by calling (800) 827-1000.

There are a variety of scholarships available to assist students with educational need. Information on most scholarships is available online, and students are encouraged to search for applicable scholarships. The Financial Aid Administrator also has a list of scholarships for which students may be eligible. If students need assistance in locating scholarships they can schedule an appointment with the

Financial Aid Administrator.

Source: Department of Education: - The Guide to Federal Student Aid

Independent students report their own income and assets (and those of a spouse, if married). You're an independent student IF at least one of the following applies to you:

If none of these criteria apply to you, you're a dependent student.

Under unique circumstances, the Financial Aid Administrator has the ability to change students who would usually be considered dependent into an independent status using her professional judgment. These circumstances must be fully documented and a copy of the documentation must be placed in the student's file.

Examples of unique circumstances which may lead to a professional judgment in dependency status include but are not limited to: a student who has been abandoned by his/her parents or a student who has had an abusive relationship with his/her family.

In order to be considered for a dependency override, the student must schedule and appointment with the Financial Aid Administrator to explain the unique circumstance. The Financial Aid Administrator will then review the application and inform the student that (s)he must provide four documents supporting the request, including a document from the student explaining the circumstances that make the situation unique. Additional documents can include letters from counselors or other, death certificates, court orders, etc. depending on the individual's situation.

The Financial Aid Administrator will then make a determination as to whether the dependency override will be granted to the student. If the override is not granted, students have the right to appeal the decision in a written letter to the Director. The Director will then meet with the student and the Financial Aid Administrator and make a final decision about the override.

John Amico School of Hair Design utilizes professional judgment at a minimal level. Only students, whose personal and financial background can be considered unusual and unique in the circumstances which are not addressed by federal regulations, will be considered on an individual case-by-case basis for professional judgment. This judgment is a discretionary opinion based on the experience and knowledge of the Financial Aid Administrator, and is only used to address unique or unusual circumstances that affect a student's eligibility.

Professional judgment can be exercised in several areas, but it is always on a case-by-case basis in the

Financial Aid Administrator's professional opinion. Areas which may be considered are as follows:

o Medical or dental expenses which are unusual and not covered by insurance

o Support of extended family members

o Expenses for elementary and secondary education tuition and dependent care

o Unusually debt

o Income reduction

Student Responsibility

Types of documents that may need to be submitted

Office.

The application processing cycle lasts 18 months. For the 2014–2015 award year, applications are accepted beginning January 1, 2014, and will be accepted through June 30, 2015. There are no exceptions to these deadlines. An electronic application cannot be received before January 1, 2014, and if it is received after June 30, 2015, it will not be processed.

Corrections through FAFSA on the Web or FAA Access to CPS Online must be received and accepted by the CPS before midnight (central time) on September 23, 2015. Address and school changes through the Federal Student Aid Information Center can be made through September 23, 2015. A school must pay or offer to pay any disbursements for a student if it receives a SAR or ISIR with an official EFC while she is enrolled and eligible, but not later than September 27, 2015. The School reserves the right to established earlier deadline on verification procedure.

A student selected for verification may submit a valid SAR or a school can receive a valid SAR after the Pell deadline published in the Federal Register but before the verification deadline established by the Department of Education and also published on the Federal Register.

If a student does not provide the verification documentation or the school does not receive the valid SAR or ISIR within the valid time, the student forfeits his Pell for the award year and must return the Pell money already received for the award year.

A student selected for verification must submit his documentations with the time frame stated on the notification letter received by the financial aid office.